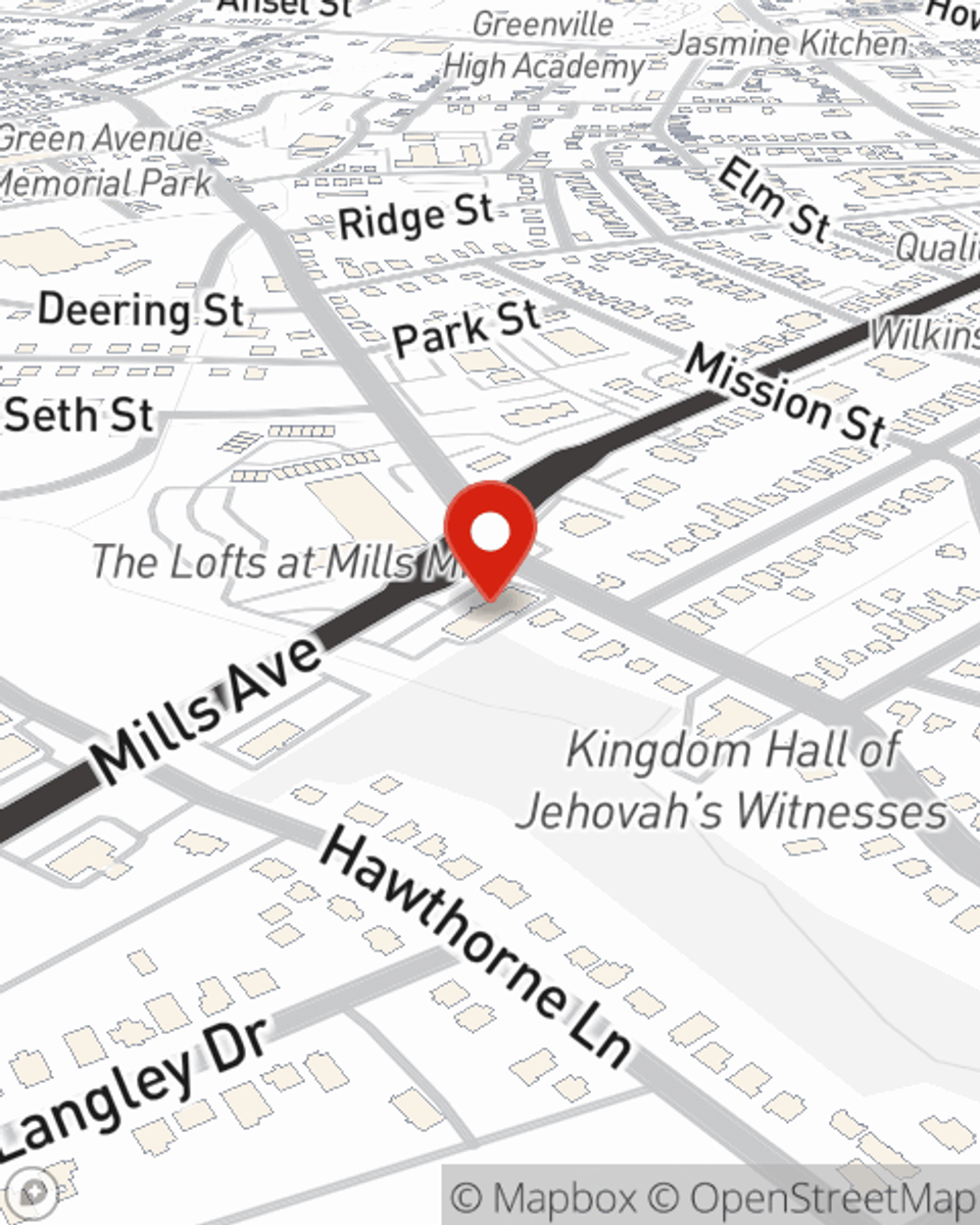

Business Insurance in and around Greenville

Greenville! Look no further for small business insurance.

No funny business here

Help Protect Your Business With State Farm.

You may be feeling overwhelmed with running your small business and that you have to handle it all alone. State Farm agent Sheldon Porter, a fellow business owner, is not unaware of the responsibility on your shoulders and is here to help you get started on a policy that's right for your needs.

Greenville! Look no further for small business insurance.

No funny business here

Small Business Insurance You Can Count On

If you're looking for a business policy that can help cover computers, extra expense, and more, State Farm may be able to help, just like they've done for other small businesses for almost 100 years.

Reach out to the outstanding team at agent Sheldon Porter's office to identify the options that may be right for you and your small business.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Sheldon Porter

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.